Las Vegas Paycheck Calculator: Quick & Accurate Earnings

<!DOCTYPE html>

Navigating your earnings in Las Vegas can be complex, especially with Nevada’s unique tax laws and local regulations. Whether you’re a resident or working temporarily in the city, understanding your take-home pay is crucial. A Las Vegas paycheck calculator simplifies this process, providing quick and accurate estimates of your net income after deductions. This tool is essential for budgeting, financial planning, and ensuring compliance with local tax requirements.

Why Use a Las Vegas Paycheck Calculator?

Las Vegas, known for its vibrant economy and diverse job market, has specific payroll considerations. Nevada’s lack of state income tax is a significant advantage, but federal taxes, FICA deductions, and other withholdings still apply. A paycheck calculator tailored for Las Vegas helps you:

- Estimate your net pay accurately.

- Account for local tax regulations.

- Plan your finances effectively.

This tool is particularly useful for employees, freelancers, and employers alike, ensuring transparency and accuracy in payroll processing. (Las Vegas payroll, Nevada tax calculator, paycheck estimator)

How Does a Las Vegas Paycheck Calculator Work?

A Las Vegas paycheck calculator operates by considering your gross income, pay frequency, and applicable deductions. Here’s a breakdown of the process:

Input Your Gross Income

Start by entering your total earnings before deductions. This includes your salary, hourly wage, or any additional income sources.

Select Pay Frequency

Choose how often you’re paid—weekly, bi-weekly, monthly, etc. This affects the calculation of deductions and net pay.

Add Deductions and Withholdings

Include federal taxes, FICA (Social Security and Medicare), and any other withholdings such as retirement contributions or health insurance premiums.

💡 Note: While Nevada doesn’t impose state income tax, federal taxes and FICA are mandatory deductions.

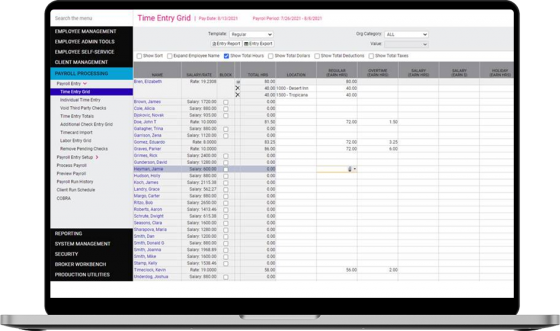

Key Features of a Reliable Paycheck Calculator

When choosing a Las Vegas paycheck calculator, look for these essential features:

| Feature | Description |

|---|---|

| User-Friendly Interface | Easy to navigate and input data. |

| Accurate Calculations | Provides precise net pay estimates based on the latest tax rates. |

| Customizable Inputs | Allows adjustments for deductions, bonuses, and other variables. |

| Mobile Compatibility | Accessible on smartphones and tablets for on-the-go calculations. |

These features ensure that the calculator meets your needs efficiently. (Payroll calculator features, accurate paycheck estimator)

Benefits of Using a Paycheck Calculator in Las Vegas

Utilizing a Las Vegas paycheck calculator offers several advantages:

- Financial Clarity: Understand your earnings and deductions in detail.

- Time-Saving: Avoid manual calculations and potential errors.

- Budgeting Assistance: Plan your expenses based on accurate net pay estimates.

- Compliance: Ensure adherence to federal and local tax regulations.

Whether you’re an employee or employer, this tool streamlines payroll management. (Financial planning, payroll compliance, budgeting tools)

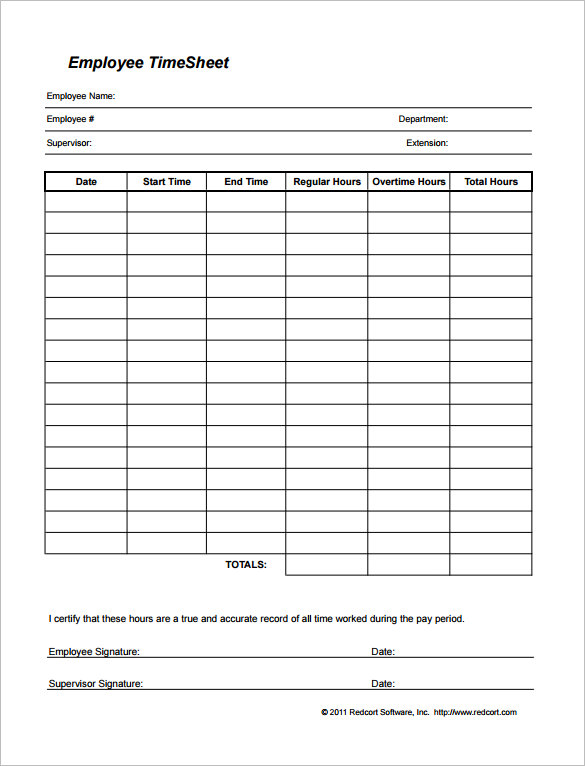

Checklist for Using a Las Vegas Paycheck Calculator

To maximize the benefits of a paycheck calculator, follow this checklist:

- Gather all necessary income and deduction details.

- Verify the accuracy of input data.

- Review the calculated net pay for consistency.

- Use the results for budgeting and financial planning.

By following these steps, you’ll ensure accurate and reliable calculations. (Paycheck calculation checklist, payroll accuracy)

In summary, a Las Vegas paycheck calculator is an indispensable tool for anyone managing earnings in the city. It provides quick, accurate estimates, helps with financial planning, and ensures compliance with tax regulations. By understanding how it works and utilizing its features, you can take control of your finances with confidence.

What is a Las Vegas paycheck calculator?

+A Las Vegas paycheck calculator is a tool that estimates your net pay after accounting for federal taxes, FICA, and other deductions, tailored to Nevada’s tax laws.

Does Nevada have state income tax?

+No, Nevada does not impose state income tax, making it unique compared to other states.

Can I use a paycheck calculator for hourly wages?

+Yes, most paycheck calculators allow you to input hourly wages and hours worked to estimate your earnings.

Is a paycheck calculator accurate for freelancers?

+Yes, freelancers can use a paycheck calculator by inputting their gross income and applicable deductions for accurate estimates.