Towson Housing Costs: What to Expect in 2023

If you’re considering a move to Towson, Maryland, understanding the housing market is crucial. Towson, known for its vibrant community, excellent schools, and proximity to Baltimore, has seen fluctuations in housing costs over the years. In 2023, several factors are influencing the market, making it essential for both renters and buyers to stay informed. Whether you’re a student, young professional, or family, this guide will help you navigate Towson housing costs and make informed decisions.

Current Trends in Towson Housing Costs

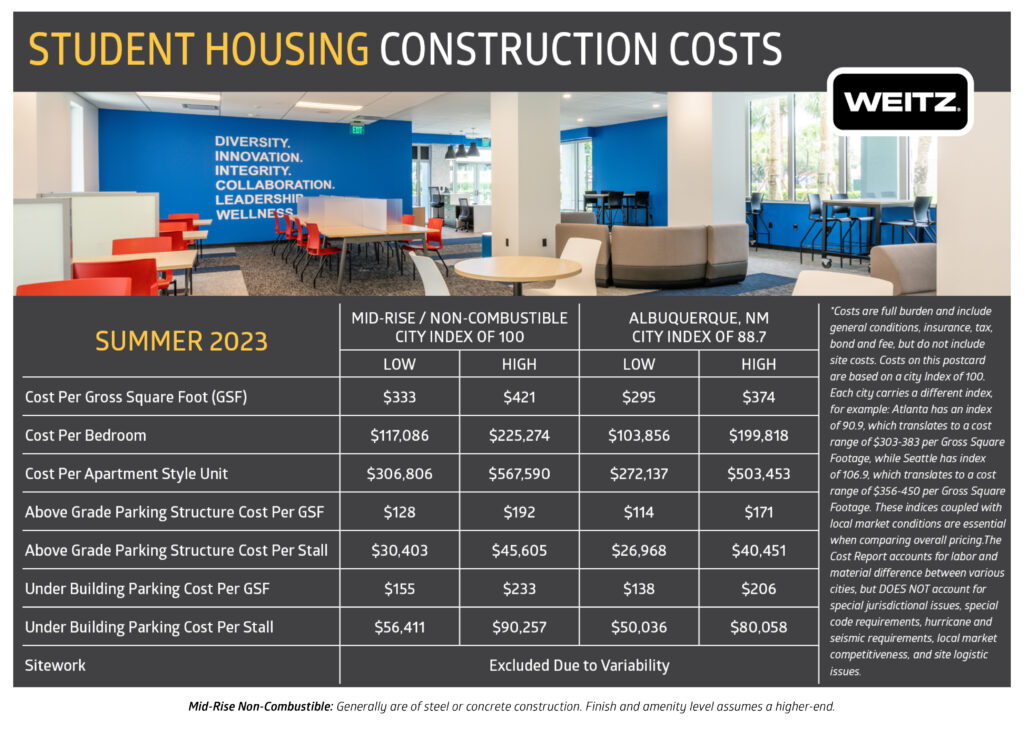

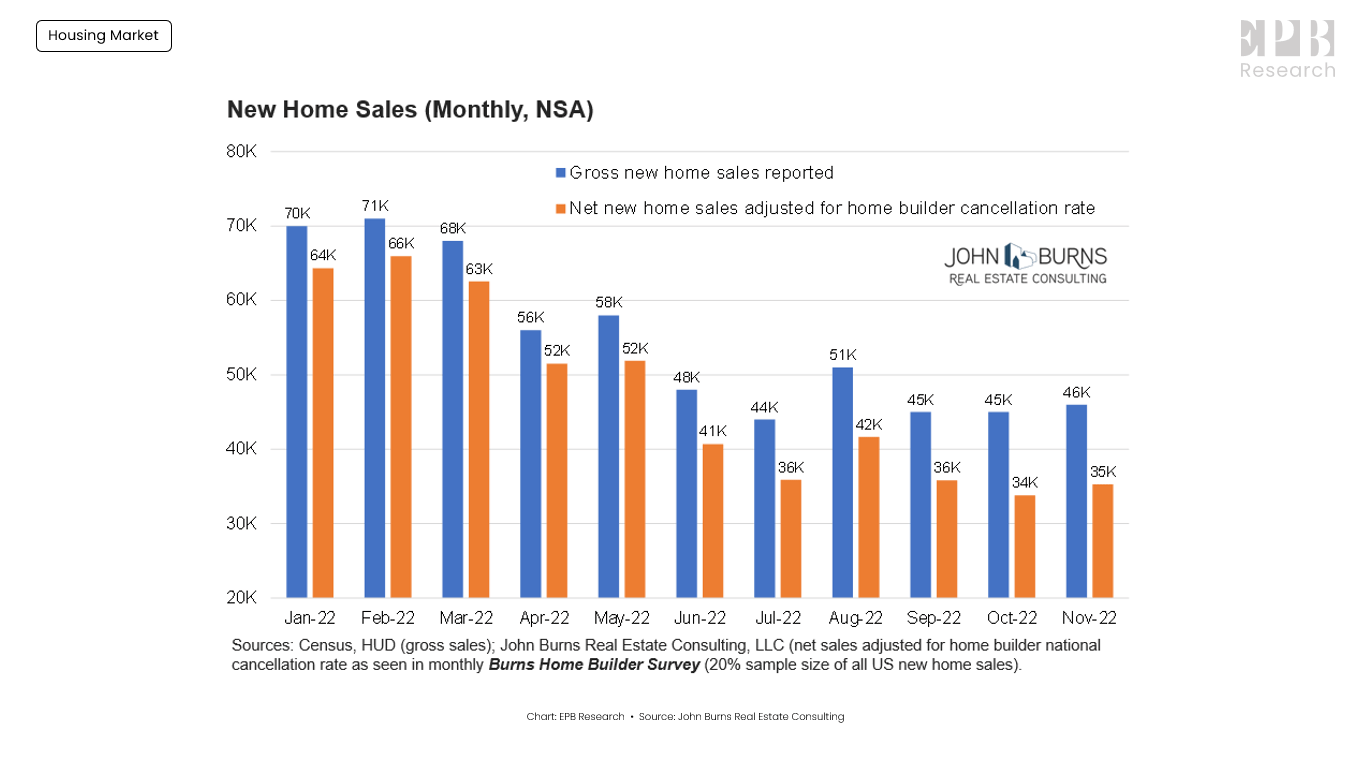

The Towson housing market in 2023 reflects broader national trends, with home prices and rental rates continuing to rise. According to recent data, the median home price in Towson is approximately 350,000, up 5% from the previous year. Rental prices have also increased, with the average one-bedroom apartment now costing around 1,500 per month. These trends are driven by high demand, limited inventory, and rising construction costs.

For those looking to rent in Towson, it’s important to act quickly, as desirable properties often go off the market within days. Buyers, on the other hand, should prepare for competitive bidding wars, especially in popular neighborhoods like Rodgers Forge and Hampton.

Factors Influencing Towson Housing Costs

Several key factors are shaping the Towson housing market in 2023:

- Proximity to Baltimore: Towson’s location near Baltimore makes it an attractive option for commuters, driving up demand.

- Educational Institutions: The presence of Towson University and Goucher College increases demand for student housing and rentals.

- Economic Growth: Baltimore County’s growing economy has led to an influx of professionals seeking housing in Towson.

- Interest Rates: Fluctuating mortgage rates impact affordability for buyers, though Towson remains relatively affordable compared to other Maryland suburbs.

📌 Note: Keep an eye on local development projects, as new housing options may emerge in the coming months.

Tips for Renters and Buyers in Towson

Whether you’re renting or buying, here are some actionable tips to navigate Towson’s housing market:

For Renters:

- Start your search early and use online platforms to monitor new listings.

- Consider roommates to split costs, especially in pricier neighborhoods.

- Negotiate lease terms, such as rent or move-in dates, if possible.

For Buyers:

- Get pre-approved for a mortgage to strengthen your offer.

- Work with a local real estate agent who understands Towson’s market.

- Be prepared to act quickly and make competitive offers.

Affordable Housing Options in Towson

While Towson’s housing costs are rising, there are still affordable options available. Here’s a breakdown:

| Housing Type | Average Cost | Best For |

|---|---|---|

| One-Bedroom Apartment | $1,500/month | Singles or couples |

| Two-Bedroom Apartment | $1,800/month | Small families or roommates |

| Starter Home | 250,000 - 300,000 | First-time buyers |

| Luxury Home | $500,000+ | High-income families |

💡 Note: Explore government assistance programs or first-time homebuyer incentives to reduce costs.

To summarize, Towson’s housing market in 2023 is competitive but offers opportunities for those who are prepared. Whether you’re renting or buying, staying informed and acting quickly are key to securing your ideal home.

What is the average rent in Towson in 2023?

+The average rent for a one-bedroom apartment in Towson is around $1,500 per month.

Are home prices in Towson expected to rise further?

+Yes, home prices are expected to continue rising due to high demand and limited inventory.

What are the most affordable neighborhoods in Towson?

+Neighborhoods like Lutherville and Timonium offer more affordable housing options compared to Rodgers Forge or Hampton.

Towson housing costs, Towson rental prices, Towson home prices, affordable housing in Towson, Towson real estate market,keyword/title,keyword/title,etc.