Interest Payable vs. Interest Expense: Key Differences Explained

Understanding the nuances between interest payable and interest expense is crucial for accurate financial reporting and management. These terms, while related, serve distinct purposes in accounting and financial analysis. This post will break down their definitions, differences, and implications, ensuring you grasp their roles in your financial statements.

What is Interest Payable?

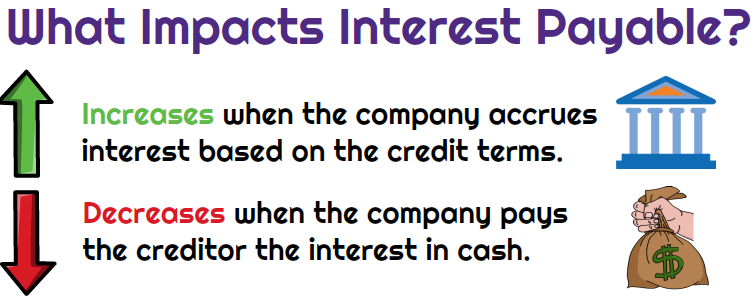

Interest payable is a liability account that represents the amount of interest owed but not yet paid to creditors or lenders. It is recorded on the balance sheet and reflects the obligation a company has to settle in the future.

📌 Note: Interest payable is a current liability, meaning it is due within one year or the operating cycle, whichever is longer.

What is Interest Expense?

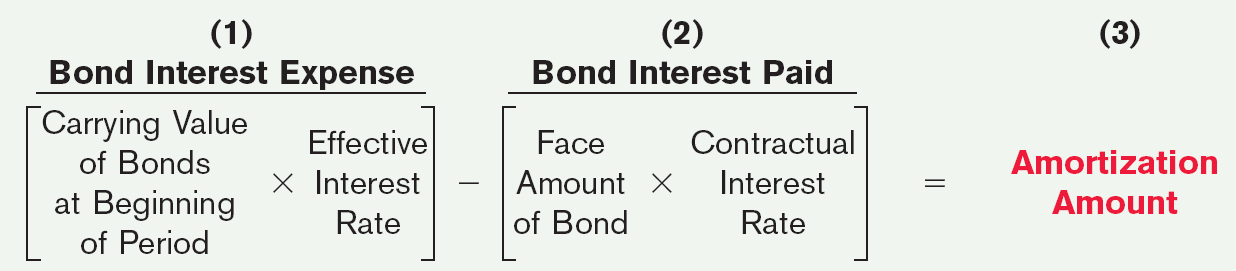

Interest expense, on the other hand, is an income statement account that shows the cost of borrowing money during a specific period. It represents the interest incurred, regardless of whether it has been paid or not.

📌 Note: Interest expense reduces a company’s net income and is tax-deductible, making it a critical component of financial analysis.

Key Differences Between Interest Payable and Interest Expense

To clarify their distinctions, let’s compare them in a table:

| Aspect | Interest Payable | Interest Expense |

|---|---|---|

| Financial Statement | Balance Sheet (Liability) | Income Statement (Expense) |

| Timing | Amount owed but not paid | Amount incurred during the period |

| Impact | Reflects future obligation | Reduces net income |

How They Work Together

While distinct, interest payable and interest expense are interconnected. For example, if a company incurs 1,000 in interest during a month but pays only 800, the remaining 200 becomes interest payable. The 1,000 is recorded as interest expense on the income statement, while the $200 is shown as a liability on the balance sheet.

Why It Matters for Businesses

Understanding these terms is vital for:

- Financial Reporting: Ensures accuracy in both income statements and balance sheets.

- Cash Flow Management: Helps businesses plan for future interest payments.

- Tax Planning: Interest expense is tax-deductible, impacting taxable income.

Checklist for Tracking Interest Payable and Interest Expense

- Record Interest Expense: Accurately calculate and record interest incurred each period.

- Update Interest Payable: Ensure the balance sheet reflects unpaid interest obligations.

- Reconcile Regularly: Match interest expense with payments to avoid discrepancies.

- Monitor Tax Implications: Leverage interest expense for tax deductions.

Wrapping Up

In summary, interest payable and interest expense are distinct yet interconnected financial concepts. While interest payable is a liability on the balance sheet, interest expense is an income statement item that reduces net income. Mastering these terms enhances financial accuracy and strategic decision-making.

What is the main difference between interest payable and interest expense?

+Interest payable is a liability on the balance sheet, representing unpaid interest, while interest expense is an income statement item showing the cost of borrowing.

Is interest expense tax-deductible?

+Yes, interest expense is tax-deductible, reducing a company’s taxable income.

How does interest payable affect the balance sheet?

+Interest payable increases the total liabilities on the balance sheet, reflecting future obligations.

interest payable, interest expense, financial reporting, tax deductions, balance sheet, income statement.